Volton helps you unlock the full potential of your assets.

Book a demo

OUR SERVICES:

Power Trading

Flexibility Trading

Reporting

Modelling

Forecasting

Power trading

24/7 trading on the Nord Pool spot markets

Volton is an active and licensed Balance Responsible Party, capable of fulfilling all your production and consumption needs. We trade continuously on the Nord Pool spot markets, both day-ahead and intraday, our trading strategies formed based on rigourous analyses of past data, current conditions and future forecasts.

BRP

Ready to manage your assets.

24/7

Continuous trading for optimal results.

20 GWh

A trusted partner with a proven track record.

Flexibility trading

Unlock new revenues from responding to frequency deviations

Volton allows your assets to take part on the flexibility markets, where power is procured or curtailed in response to the frequency deviations caused by system imbalance. These special markets are highly volatile and unsaturated, offering attractive new possibilities for extra revenue to your flexible energy assets. We have already successfully traded on these markets for our clients, with a total volume of 80 MW.

Markets

Capacity & energy, UP & DOWN, mFRR & aFRR

Automatic

bidding and activations for passive income.

80 MW

Qualified portfolio across markets.

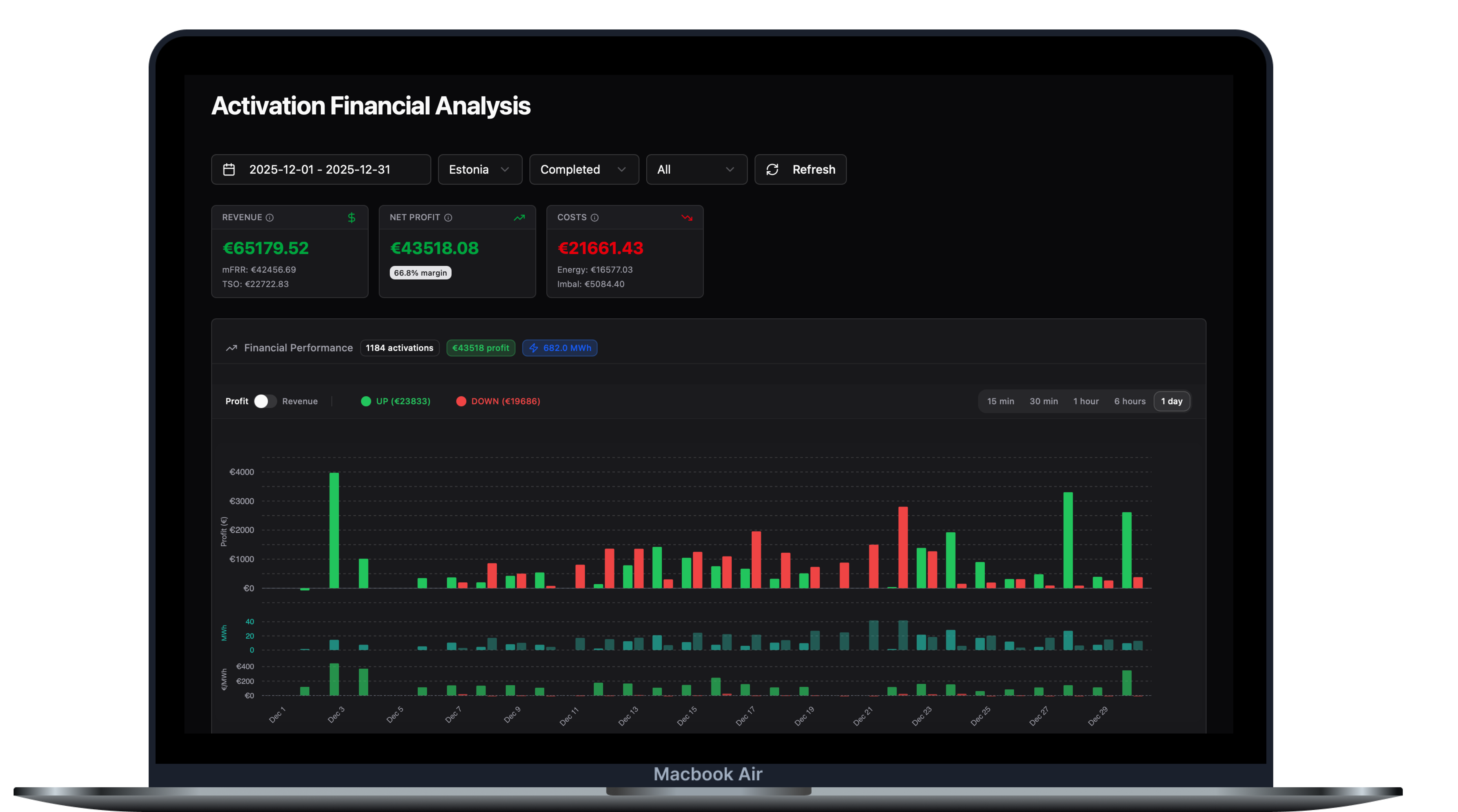

Reporting

A clean visual dashboard for each client or asset

Get an instant overview of your assets. Your dashboard is customised to your personal needs, so you always have access to all the information you desire. Look at past performance, real-time production/consumption or running profits. Use verified data for ESG and sustainability reporting, or informing internal decisions.

Personal

Customised reporting to individual needs.

24/7

Real-time data, always available.

All-inclusive

Production, revenue, costs, forecasts – all in one place.

Modelling

Data-driven modelling for informed energy investments

By combining market data, asset constraints, and operational logic, we estimate revenues, costs, risks, and upside potential across different market scenarios — providing a solid foundation for valuation, financing, management and investment decisions across a wide array of energy asset classes.

Purposes

Investment, Financing, Management

4 markets

To get the most accurate models for every asset.

2 weeks

You shouldn't have to wait longer.

Forecasting

Valuable insight before the market moves

By combining historical data, weather inputs, and market dynamics, we provide forward-looking views of power prices, generation profiles, and system conditions – enabling better bidding strategies, risk management, revenue optimisation, and investment decisions.

Full-package

Production, Prices, Market dynamics, & Imbalance

1 month ahead

So we're always a step ahead.

AI-native

Making the best use of currently available technology.

HOW IT WORKS

1. Assess & Align

We start by understanding your assets, objectives, and market exposure. This includes reviewing your technical setup, regulatory position, and commercial goals to determine the optimal trading and optimisation strategy.

2. Onboard & Integrate

Once aligned, we formalise the partnership and integrate your assets into our platform. This includes contract execution, data connections, system integration, and operational setup to ensure seamless and secure market access.

3. Optimise & Trade

After prequalification, we activate trading and optimisation. Our systems continuously analyse markets, dispatch assets, and manage risk in real time to maximise value across day-ahead, intraday, and balancing markets.

Any burning questions?

Check out our FAQ

Marit Rahel Kesker

Sales Manager

marit@volton.ee

+372 5303 3252