What are the flexibility markets?

Markets that reward responding to supply and demand in real-time.

Why are flexibility markets needed?

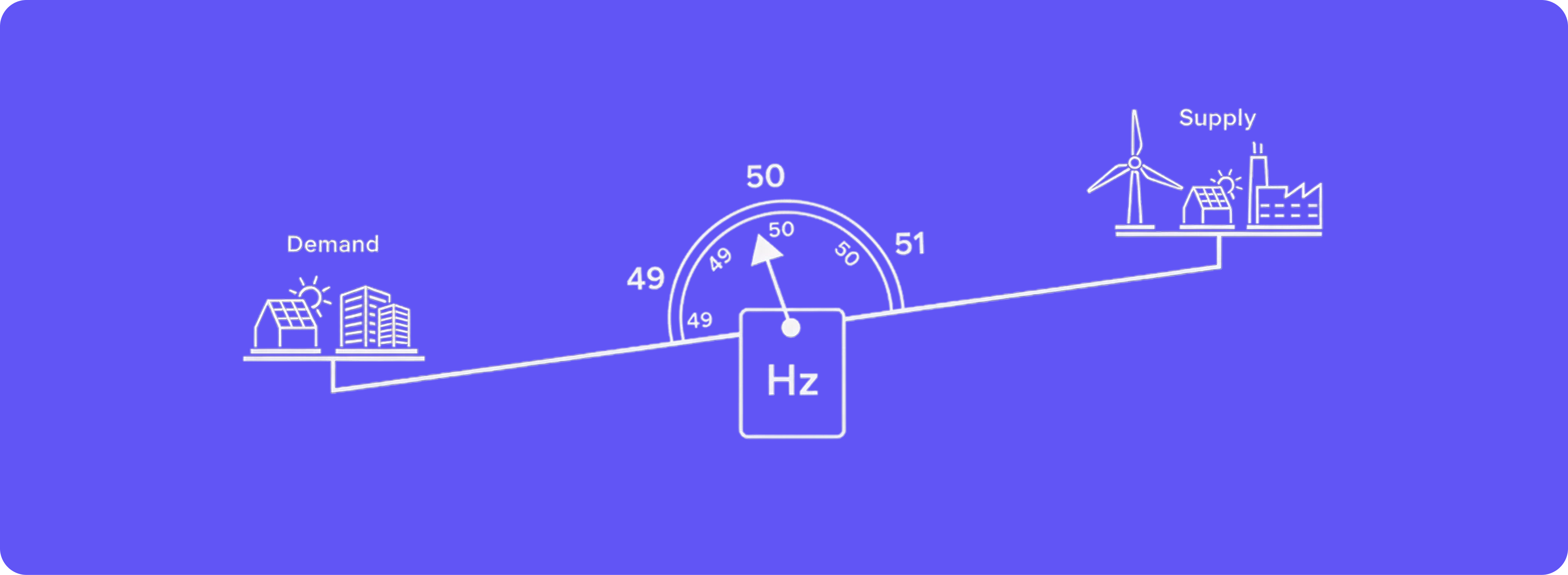

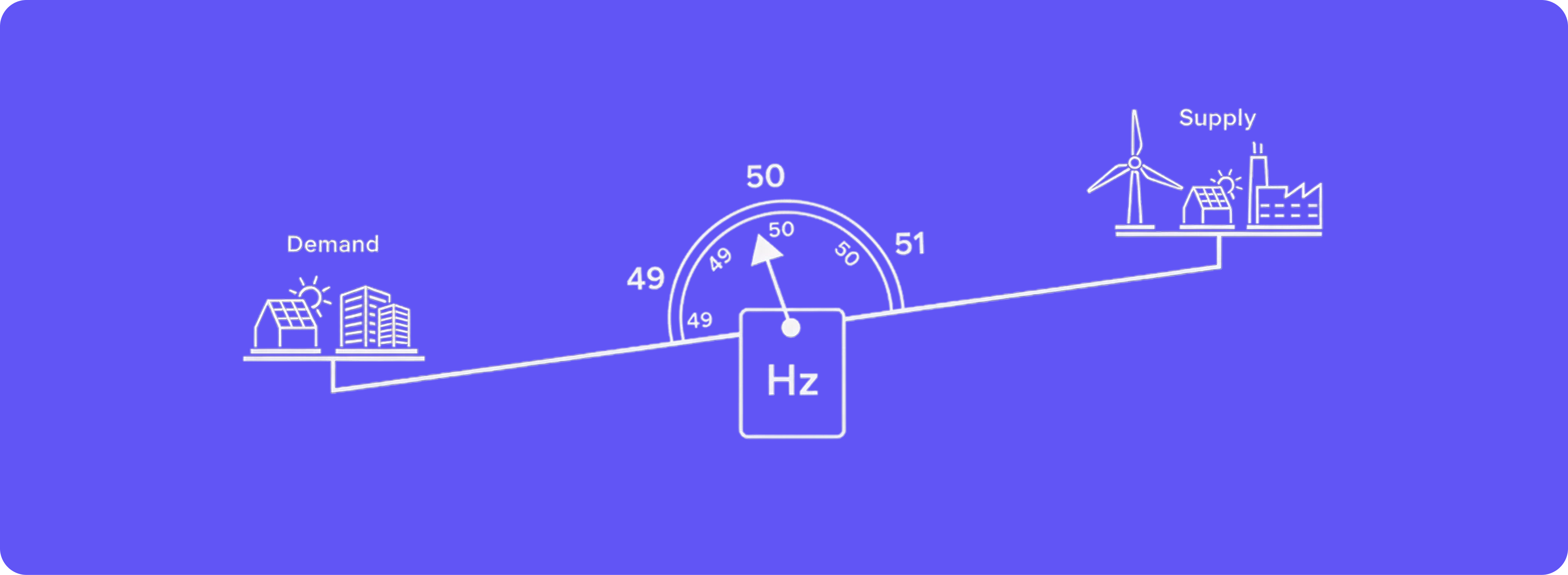

Electricity systems must remain perfectly balanced at all times — supply must match demand every second. When the real production or consumption deviates from the forecasts, like due to a technical fault or stringer winds, the frequency at which the grid operates becomes unstable, possibly causing damage to electrical appliances or sometimes even total blackouts. As more renewable energy is added to the grid, this balance between supply and demand becomes harder to maintain because wind and solar generation are variable and less predictable.

Flexibility markets exist to solve this problem.

They allow grid operators to buy fast, controllable responses from assets that can increase or decrease power production or consumption when the system needs it. This keeps the grid stable, prevents outages, and reduces the need for expensive backup generation.

How do the markets work?

Flexibility markets work alongside the day-ahead and intraday electricity markets to help keep the power system balanced in real time. They allow participants to offer flexibility by adjusting how much electricity they produce or use — for example by ramping generation up or down, or shifting consumption when needed. These offers are sent to a central system, where the system operator, such as Elering in Estonia, activates them whenever imbalances arise due to changing weather, forecast errors, or sudden shifts in demand. By selecting the most cost-effective options, the grid stays stable and reliable. In return, participants are paid for being available and for the energy they deliver or reduce when called upon, turning flexibility into a simple and valuable revenue opportunity

Who can participate?

Participation in flexibility markets is open to a wide range of assets capable of adjusting their electricity production or consumption in response to system needs. This includes battery energy storage systems, wind and solar plants with controllable output, flexible industrial and commercial loads, data centres, combined heat and power units, and aggregated portfolios of smaller assets. Participants may access the market directly or through an aggregator or trading partner, like Volton, depending on their size and capabilities. To participate, assets must meet defined technical requirements such as reliable real-time metering, remote control or automation capability, secure data communication, and compliance with grid and market regulations set by the system operator.

How are participants rewarded?

Participants in flexibility markets are rewarded based on both their availability and their actual activation when the system requires support. Depending on the market, this includes payments for being available to provide flexibility, as well as payments for the energy delivered or reduced when an activation occurs. Revenues are calculated according to market prices and activation volumes and are typically settled through their chosen aggregator or trading partner, usually invoiced on a monthly basis. This structure allows participants to access flexibility revenues without directly interacting with complex market processes, while ensuring transparent and reliable compensation for the services provided.

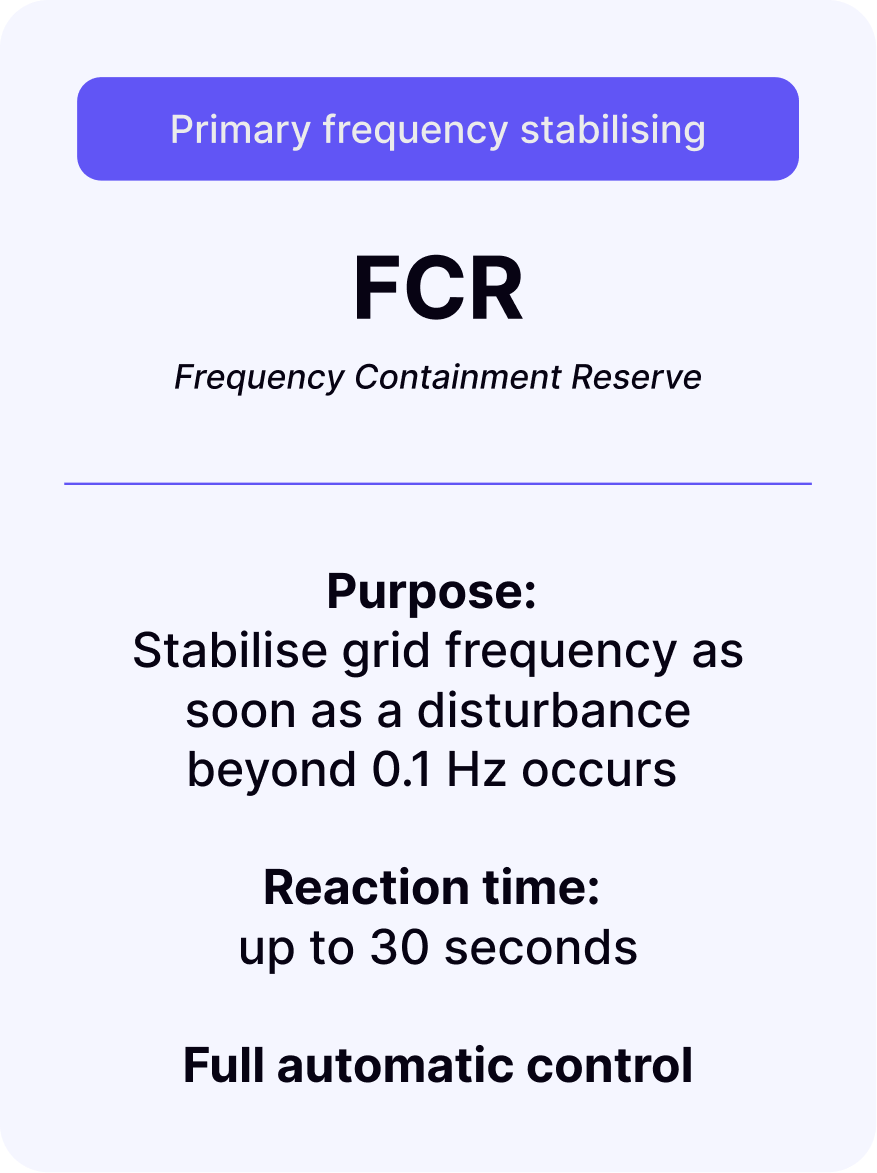

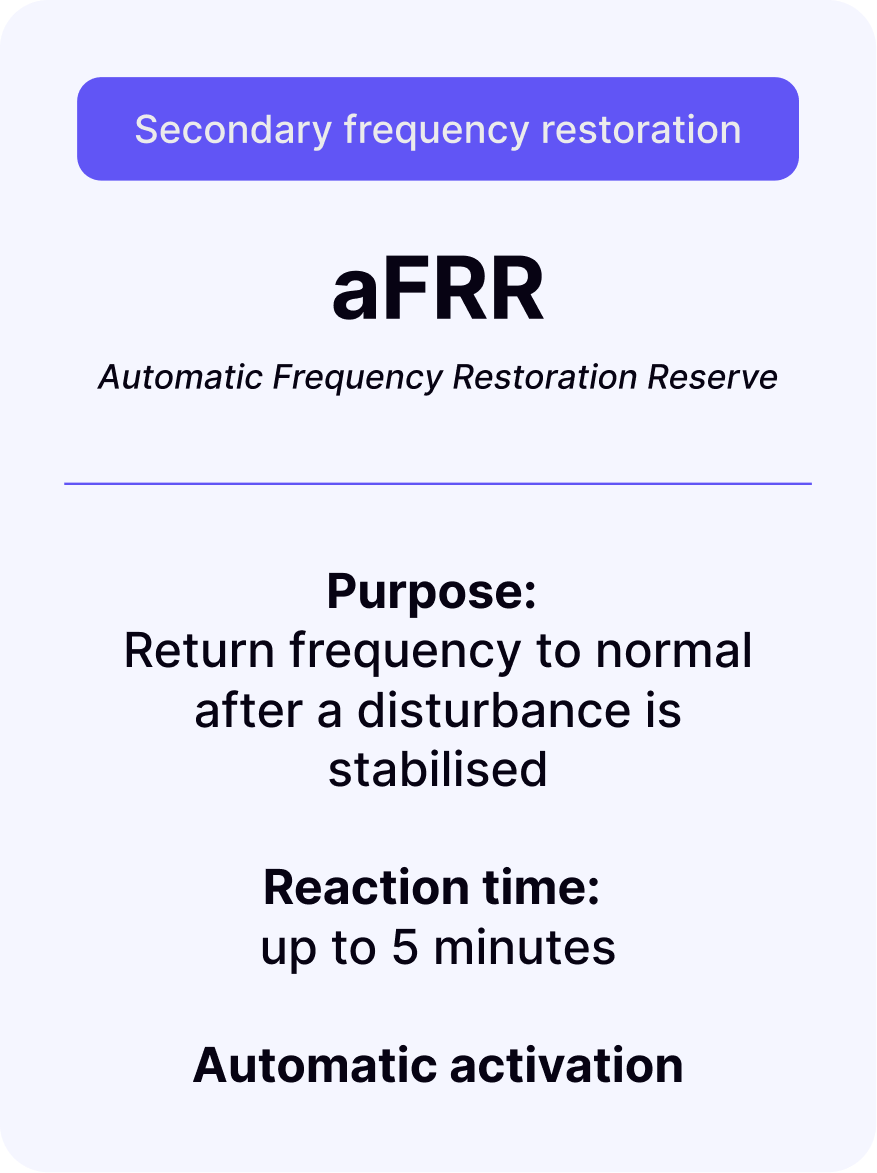

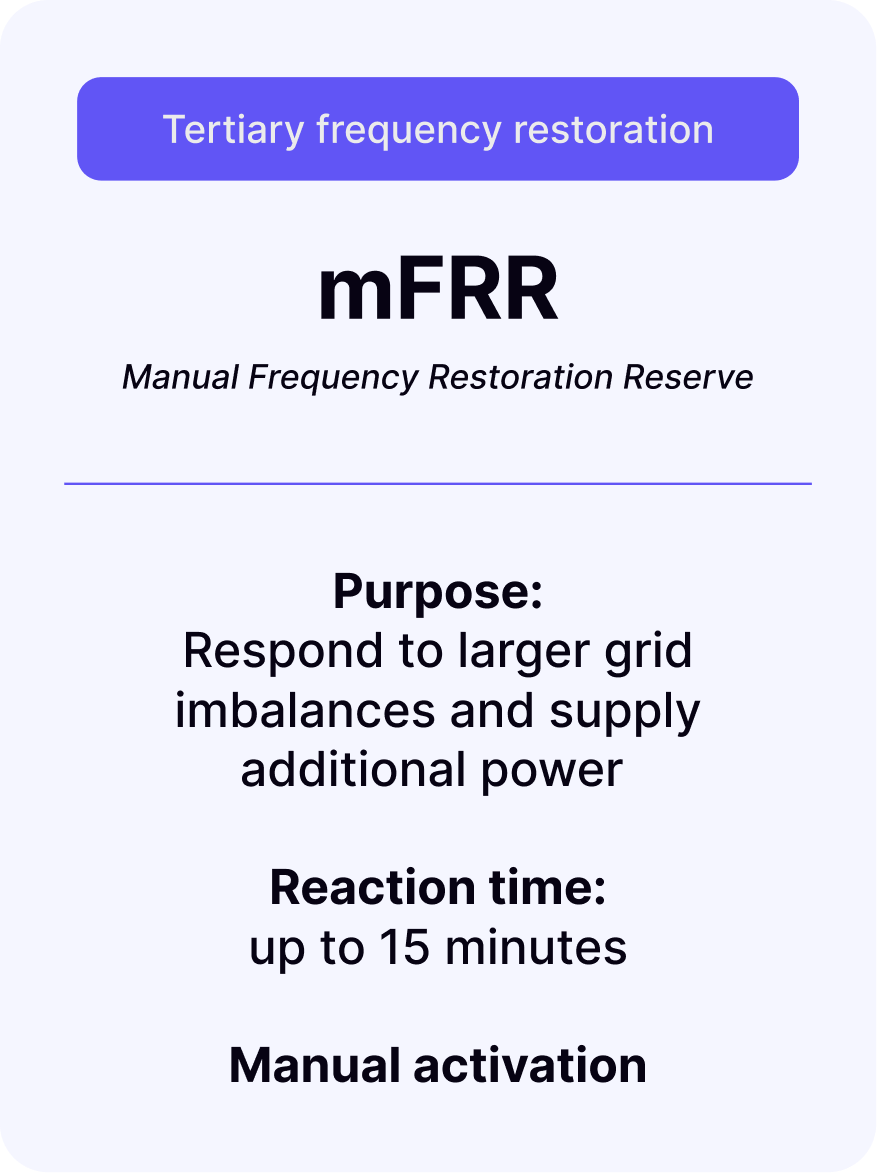

Market types

Volton helps you instantly tap into flexibility markets. We take care of market access, technical integration, and ongoing operations, while you gain straightforward access to new revenue opportunities and the confidence that everything is handled reliably and transparently.

Interested?

Let's talkSee our offer

Services